aurora sales tax rate 2021

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Aurora-RTD 290 100 010 025 375.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

The current total local sales tax rate in Aurora MO is 8850.

. Note that failure to. The Sales tax rates may differ depending on the type of purchase. An alternative sales tax rate of 675 applies in the tax region Centennial which appertains to zip code 80046.

Note that the State of Colorado has enacted the same clarification. The Aurora Illinois sales tax is 625 the same as the Illinois state sales tax. This rate includes any state county city and local sales taxes.

The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe County. The latest sales tax rate for Aurora OR. In no event shall the amount of tax to be held be less than 375 400 in Arapahoe County of 50 of the permit fee determination assessment.

Aurora has a higher sales tax than 886 of Colorados other cities and counties. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Method to calculate Aurora sales tax in 2021.

The Aurora Missouri sales tax is 835 consisting of 423 Missouri state sales tax and 413 Aurora local sales taxesThe local sales tax consists of a 163 county sales tax and a 250 city sales tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The current total local sales tax rate in Aurora CO is 8000.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. Method to calculate Aurora sales tax in 2021. An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80011 80012 80014 and 80019.

While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. While Colorado law allows municipalities to collect a local option sales tax of up to 42 Aurora does not currently collect a local sales tax.

The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. The Sales tax rates may differ depending on the type of purchase. Aurora collects a 56 local sales tax the maximum local sales tax allowed under Colorado law.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. The average sales tax rate in Arkansas is 8551.

Method to calculate Aurora sales tax in 2021. The current total local sales tax rate in Aurora IN is 7000. The Sales tax rates may differ depending on the type of purchase.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 2020 rates included for use while preparing your income tax deduction. Method to calculate Aurora Lodge sales tax in 2021.

The December 2020 total local sales tax rate was also 7000. The December 2020 total local sales tax rate was also 8000. Method to calculate Aurora sales tax in 2021.

There are approximately 213758 people living in the Aurora area. Did South Dakota v. The Aurora sales tax rate is 375.

What is the sales tax rate in Aurora Colorado. Friday January 01 2021. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5.

The current total local sales tax rate in Aurora OR is 0000. Wednesday July 01 2020. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax.

The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax. Groceries are exempt from the Aurora and Colorado state sales taxes. The Colorado sales tax rate is currently 29.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Aurora collects a 4125 local sales tax the maximum local sales tax allowed.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The December 2020 total local sales tax rate was also 0000. Effective December 31 2011 the Football District salesuse tax of 010 expired within Arapahoe County.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. The minimum combined 2022 sales tax rate for Aurora Colorado is 8. This clarification is effective on June 1 2021.

The County sales tax rate is 025. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. This is the total of state county and city sales tax rates. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The December 2020 total local sales tax rate was 8350. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected.

The Sales tax rates may differ depending on the type of purchase.

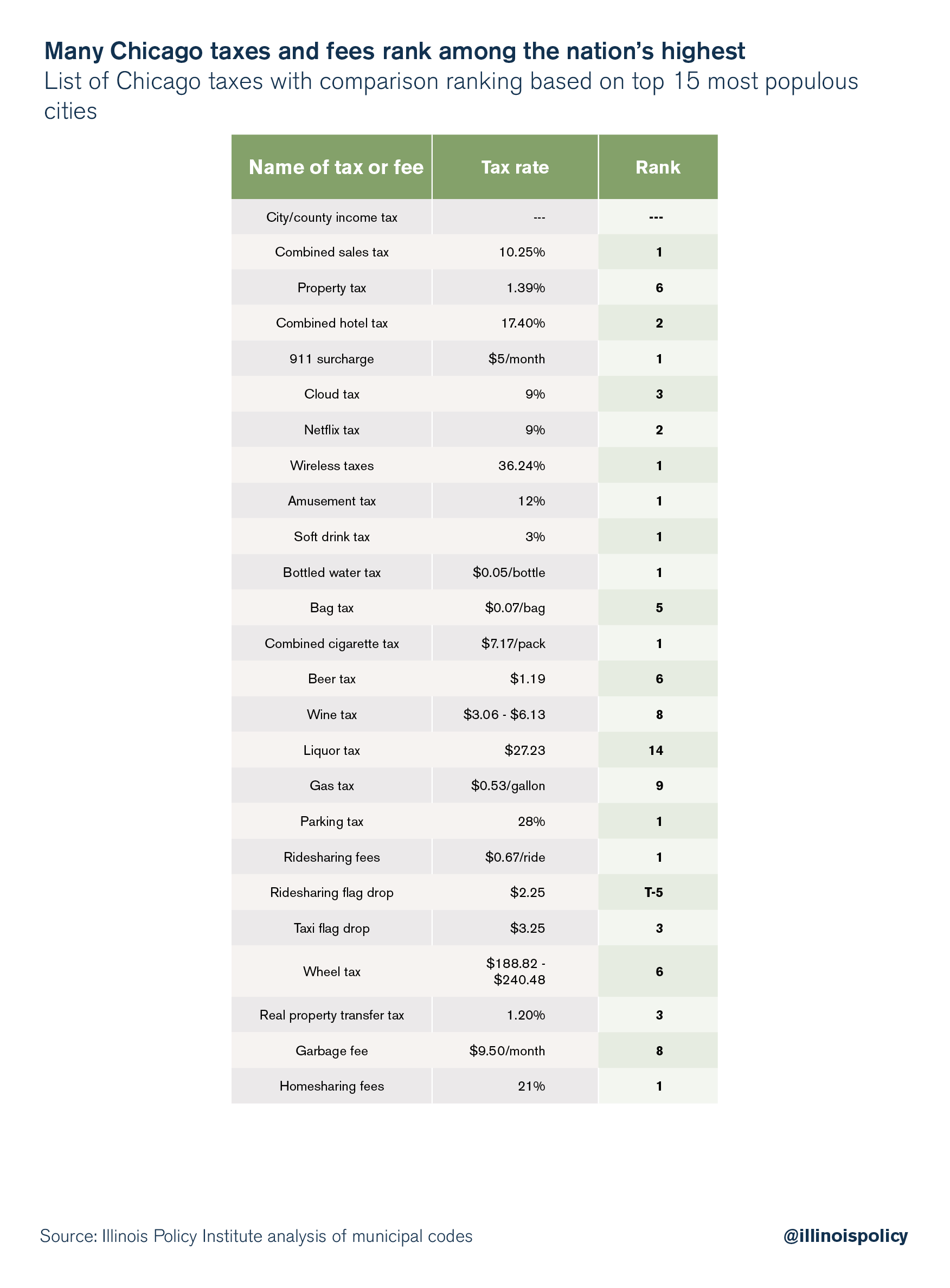

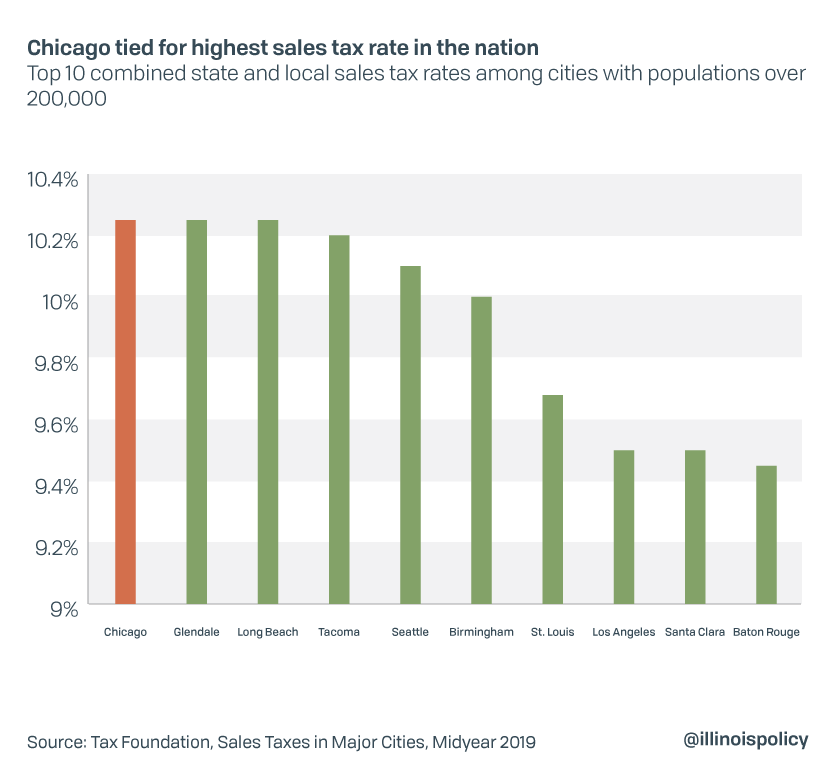

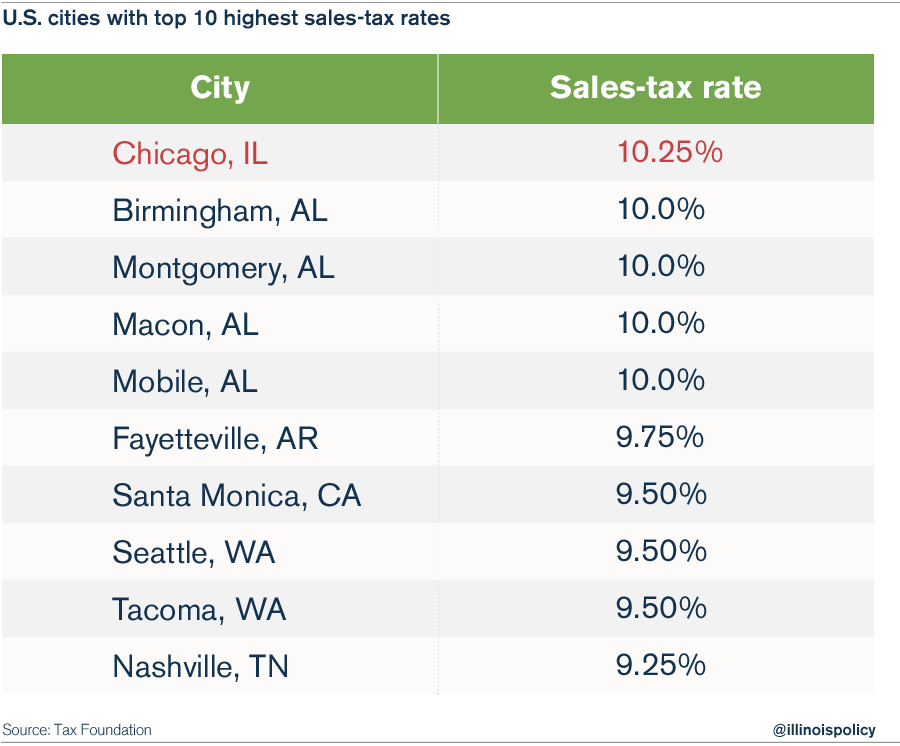

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

Ohio Sales Tax Rates By City County 2022

Iowa Sales Tax Rates By City County 2022

Utah Sales Tax Rates By City County 2022

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

Colorado Sales Tax Rates By City County 2022

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com

Kansas Sales Tax Rates By City County 2022

Property Tax Village Of Carol Stream Il

Sales Tax By State Is Saas Taxable Taxjar

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Tax Rate In Chicago Online 59 Off Www Ingeniovirtual Com